By Live Commentary

Updated: 04:52 EST, 7 November 2024

The Bank of England is expected to cut interest rates again later today, despite the reemergence of concerns about a looming revival in inflationary pressures.

Markets expect the bank’s Monetary Policy Committee to vote for another 25 basis points cut to 4.75 per cent at midday.

The FTSE 100 is up 0.1 per cent in early trading. Among the companies with reports and trading updates today are Rolls-Royce, ITV, Sainsbury’s, Taylor Wimpey, Auto Trader Group, S4 Capital and Trainline. Read the 7 November Business Live blog below.

> If you are using our app or a third-party site click here to read Business Live

House prices reach new record high of £293,999, says Halifax

House prices have hit a new high, according to Halifax, surpassing the previous peak set in June 2022 during the pandemic property boom.

The price of the average home rose for the fourth month in a row in October, according to the bank, which bases its figures on its own mortgage applications.

BoE’s December’s rate decision ‘will now prove the bigger moment’

Jeff Brummette, chief investment officer at Oakglen Wealth:

“With inflation remaining steady and effectively back to target, there remains ample room for the Bank of England and the Fed to continue with rate cuts.

“We see a world with low inflation, central banks with additional room to cut rates, generally healthy labour markets and governments continuing to implement expansionary fiscal policies. However, there remain risks that inflation may have bottomed out, rate cuts could be less aggressive than the markets expect, and geopolitical risks stay elevated.

“In the UK, it is not this week’s meeting but rather December’s rate decision which will now prove the bigger moment, with wages likely to be the key deciding factor for the Monetary Policy Committee. It will take some time for the Chancellor’s new spending commitments to be felt by the economy.

“In the US, the Fed’s interest rate decision this week should be undeterred by Trump’s reelection – at least for now.

Rolls-Royce shares slip as customer flying hours disappoint

Rolls-Royce stuck to guidance for profit growth of at least 30 per cent this year as its airline customers flew more, and demand for power for data systems and defence equipment improved.

But shares in Rolls-Royce fell on Thursday in response to slightly weaker than expected customer flying hours, with investors taking profits following gains of 487 per cent since Tufan Erginbilgic took over as chief executive in January 2023.

Solid defence and airline demand helped offset problems in the group’s aerospace supply chain, which in August the firm warned would cost it £150million to £200million this year.

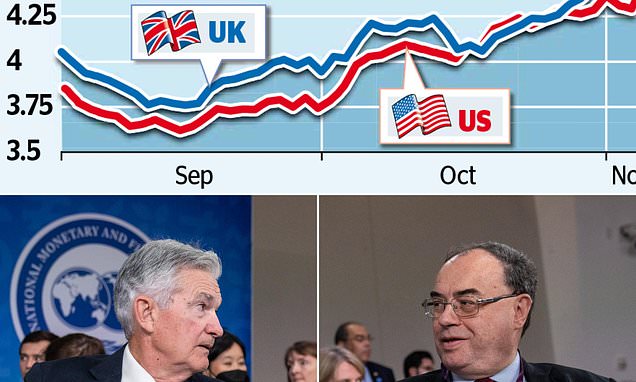

Borrowing costs soar as Trump win fuels inflation fears

Borrowing costs shot up on both sides of the Atlantic yesterday as Donald Trump’s election cast further doubt about the path of interest rate cuts after the UK Budget.

The Bank of England, led by Andrew Bailey, and US Federal Reserve, chaired by Jerome Powell, are still expected to cut rates by a quarter of a percentage point today after falls in inflation in both Britain and America.

Trump trade war could spark ‘economic nightmare’ for UK and Europe

Donald Trump’s re-election could start a trade war that would be an ‘economic nightmare’ for Britain and Europe, analysts warned last night.

He has pledged to ramp up import tariffs in his second term as US president, a move experts said could tip the eurozone into a recession.

From defence stocks to crypto – the investments you could cash in on as The Donald returns to the White House

Markets hate uncertainty, the old adage goes, so there was some relief among investors that American voters had made a clear-cut decision.

Days or weeks of political and legal wrangling over the outcome of the US election would probably have proved hugely turbulent on financial markets – and destabilising for the global economy and geopolitics.

So while the return of Donald Trump to the White House as president will stir strong feelings for many, investors can start to plan for the coming years with at least some clarity. Chaos is rarely good for investors.

Sainsbury’s Food First strategy beginning to bear fruit

Mark Crouch, market analyst at eToro:

‘Sainsbury’s shareholders were eager for some good news this morning. After the company’s largest shareholder QIA slashed their holding by a third last month, it left investors feeling uneasy, so a strong earnings report was needed to settle the nerves.

‘Despite a slow start, Sainsbury’s “Food First” strategy is now bearing fruit as grocery sales grew by 5%, while sale of the company’s Taste the Difference range jumped by a very encouraging 18%. It wasn’t all good news however as general merchandise and clothing sales dropped, and retail arm Argos saw a 5% dip in sales.

‘Investors will be anxious to see the company’s strategy translate into share price performance. Sainsbury’s main rival Tesco has seen their shares reach decade highs in 2024, while Sainsbury’s shares have recorded a double-digit decline. And while Sainsbury’s managed to grow their market share slightly, they cannot afford to rest on their laurels, with budget supermarket chains breathing down their neck, determined to pluck away scraps of market share piece by piece.’

ALEX BRUMMER: Trump tariff plans pose threat to growth

Detailed exit polling will eventually show why Republicans with Donald Trump on the top of the ballot were triumphant in the US election.

The issue which played most strongly for many Americans was inflation.

The supply-side price shocks of Covid-19, Russia’s war on Ukraine and the misleadingly titled, green-tinged Inflation Reduction Act played big with the electorate.

Rolls-Royce lifted by customer flying hours

Aarin Chiekrie, equity analyst, Hargreaves Lansdown:

‘Rolls-Royce investors would be forgiven for having their heads in the cloud of late, with Roll-Royce continuing to be the FTSE 100’s best performer so far in 2024. In a short trading update this morning, it was pleasing to see Large Engine Flying hours, the driving force behind a large chunk of its revenue, sitting above pre-pandemic levels.

‘The only slight downside is that strikes at Boeing have caused a slight delay in getting upgrades to one of its engines signed off. But with this approval still expected in the coming months, investors won’t be too worried. All full-year guidance remains on track, with underlying operating profits between £2.1-£2.3bn expected, helping to fund the return of dividends at the end of its financial year.’

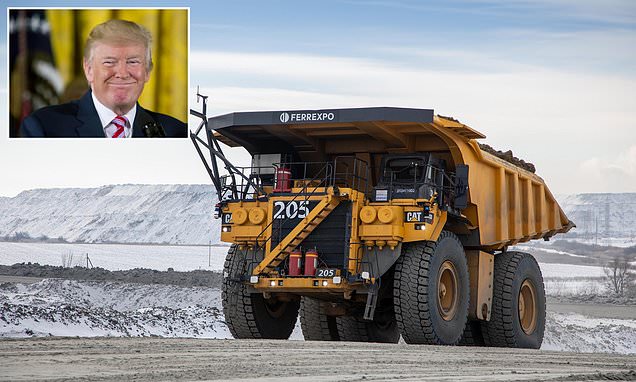

MARKET REPORT: Ferrexpo soars on hopes of an end to Ukraine war

Ukraine-based iron ore miner Ferrexpo saw its shares hit a nine-month high with the election of Donald Trump.

The world’s third-largest exporter of iron ore pellets rocketed 27.3 per cent, or 17p, to 79.2p as traders placed bets on Trump bringing a swift end to the war with Russia, which Trump said he would do in ‘one day’ after taking power.

Ferrexpo has continued to operate its iron ore mines in Ukraine, despite the invasion in early 2022. But it has had to continually deal with disruptions to its supply lines, which have weighed on the performance of the business.

Sir Martin Sorrell’s S4 Capital sees shares hit record low on profit warning

Sir Martin Sorrell’s ad group S4 Capital has issued a profit warning and forecast a low double-digit decline in its annual like-for-like net revenue after a tough third quarter due to underperformance from content and tech clients.

Shares of S4 Capital have slumped as much as 17 per cent to a record low in early trade.

This is the second revenue warning in less than two months from S4, which derives almost half of its business from the technology sector.

‘In light of the continued net revenue softness, we have maintained the heightened focus on cost reduction,’ said Chairman Sorrell, who founded S4 after leaving rival WPP in 2018.

Some technology clients have continued to tighten their marketing spend due to a challenging broader economic environment and elevated interested rates, Sorrell said.

S4, however, said that new business activity continued at significant levels and there was a particular focus on AI-driven hyper-personalisation at scale.

Sainsbury’s grocery sales offset general merchandise weakness

Sainsbury’s has maintained forecasts for full-year profit growth of up to 10 per cent as the supermarket reported a 3.7 per cnet rise for the first half, with robust grocery sales offset by a weaker performance in general merchandise.

Under CEO Simon Roberts, Sainsbury’s strategy to match discounter Aldi’s prices on hundreds of essential items and provide better offers for members of its Nectar loyalty scheme, financed by cutting costs, is paying off.

Britain’s No. 2 grocer after Tesco said it still expected 2024/25 retail underlying operating profit, its preferred profit measure, of £1.01billion to £1.06billion, reflecting growth of 5 to 10 per cent versus 2023/24.

The group said it also still expected to generate retail free cash flow of at least £500million.

ITV Studios still suffers US strikes

ITV revenues slipped 8 per cent in the first nine months of the year, dragged down by lower revenue in its studios business that continues to face the impact of phased deliveries from the US writers’ and actors’ strike last year.

Revenue decreased to £2.74billion pounds in the nine months to 30 September, from £2.98billion a year earlier.

Boss Carolyn McCall said: ‘ITV Studios is performing well despite the expected impact of both the writer’s strike and a softer market from free-to-air broadcasters.

‘ITV Studios has had an excellent start to Q4, in line with expectations, which will ensure it achieves record profits in 2024.

‘Studios has great creative and commercial momentum as demonstrated in the last few weeks with shows including Rivals for Disney+ and Ludwig for the BBC and is on track to deliver good revenue growth in 2025 and 2026.’

Rolls-Royce faces supply chain hit of up to £200m

Rolls-Royce has stuck to annual proft guidance despite warning it could face a hit from supply chain issues costing as much as £200million.

The group expects to post annual profit growth of at least 30 per cent this year as its airline customers flew more and demand for power for data systems and defence equipment continued to grow.

That strength offset problems in the aerospace supply chain which has caused delays for parts, and which the company warned in August would cost £150million to £200million this year.

‘Continued good performance year to date gives us further confidence in the delivery of our 2024 guidance despite a supply chain environment which remains challenging,’ chief executive Tufan Erginbilgic said.

BofE and Fed set to cut rates today: UK rate setters likely to stay tight lipped on outlook

Michiel Tukker, senior european rates strategist at ING:

‘The main focus in the wake of the elections is the policy-setting meetings of the Fed and the BoE.

‘The Fed is firmly expected to cut by another 25bp, but the elections have important implications for the longer-run outlook of the Fed.

‘Chair Powell’s commentary on the current economic environment and how the next US president could likely influence the outlook will be of huge significance.

‘The BoE is also very likely to cut rates by 25bp again, but the combination of extra fiscal stimulus and the US election aftermath means officials won’t want to comment on its next steps.’

BofE expected to cut base rate at midday

The Bank of England is expected to cut interest rates again later today, despite the reemergence of concerns about a looming revival in inflationary pressures.

Markets expect the bank’s Monetary Policy Committee to vote for another 25 basis points cut to 4.75 per cent at midday.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.

This post was originally published on this site