By LIVE COMMENTARY

Updated: 12:27 EST, 22 January 2025

The FTSE 100 closed down 3.16 points at 8545.13 after hitting a new intraday record of 8,584.73 earlier in the session.

Government borrowing came in far higher than expected in December as a result of debt interest and a one-off purchase of military homes, data from the Office for National Statistics shows.

Public sector net borrowing of £17.8billion for the month exceeded market forecasts of £14.1billion and will put further pressure on Chancellor Rachel Reeves’ commitment to her fiscal rules.

Among the companies with reports and trading updates today are EasyJet, JD Wetherspoon, EnQuest and Herald Investment Trust. Read the Wednesday 22 January Business Live blog below.

> If you are using our app or a third-party site click here to read Business Live

FTSE 100 closes down 3.16 points at 8545.13

Quilter sees record inflows boost thanks to high net worth boost

Quilter achieved record net inflows in its core segment last year, with the wealth manager seeing particularly strong demand among high-net-worth clients.

The group said core net inflows totalled £5.2billion in 2024, more than six times the £832million of the prior year.

Herald Investment Trust shareholders vote AGAINST Saba takeover

The board of Herald Investment Trust has claimed victory over Saba Capital after shareholders rejected the hedge fund’s attempt to seize control of the company.

Herald was the first of seven London-listed investment trusts targeted by Saba Capital to see the hedge fund’s proposals taken to a shareholder vote.

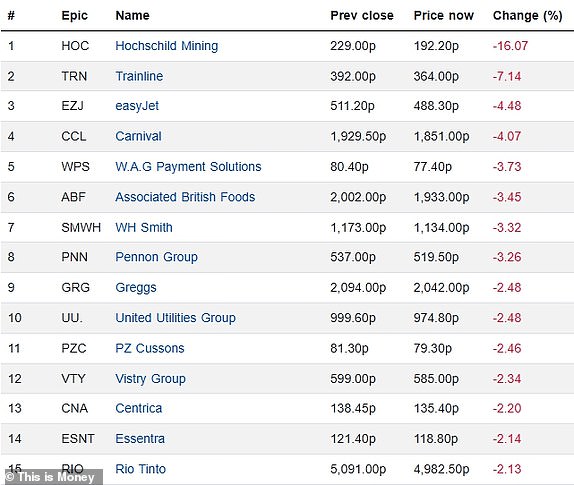

Hochschild Mining shares top FTSE 350 fallers

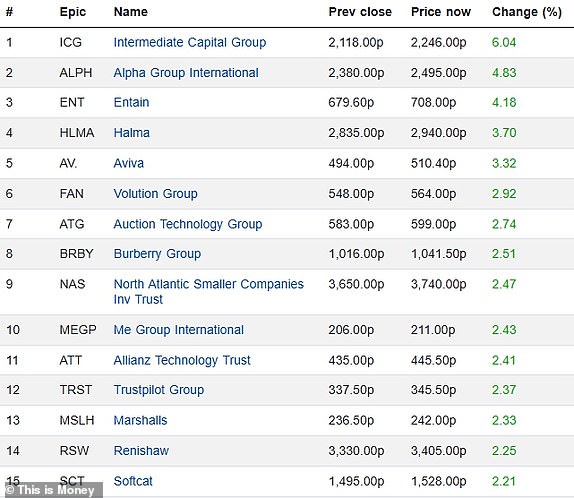

Intermediate Capital Group shares top FTSE 350 risers

Can former Amazon UK boss Doug Gurr help deliver growth as CMA chief?

Doug Gurr, the former boss of Amazon UK, has been appointed as the Competition and Markets Authority’s new chair following a dramatic Government intervention.

Keir Starmer and Rachel Reeves’ quest for ‘growth’ saw government ministers oust the CMA’s former chair Marcus Bokkerink, who had held the post since 2022.

HMRC will end ‘over-taxation trap’ on pension withdrawals

HMRC is to end the ‘scandalous’ practice of overtaxing pension withdrawals and forcing savers to claim refunds.

It has bowed to pressure after pensioners had to reclaim £1.3billion of their own cash over the past decade – including £50million in the past six months.

Netflix customers vow to boycott streaming giant after price rise

Furious Netflix customers have vowed to boycott the streamer after announcing another price rise, despite a major surge in subscribers.

EnQuest to acquire Harbour Energy’s business in Vietnam

EnQuest plans to buy Harbour Energy’s Vietnamese business in an $84million (£68million) deal as it seeks to expand operations outside the UK.

The London-based energy exploration business will acquire Harbour’s majority stake in the Chim Sáo and Dua production fields, which it plans to operate after completing the transaction.

LadBible owner eyes further US investment after ‘transformational year’

Mistake savers are making that’s costing billions: SYLVIA MORRIS

The time may have arrived for savers to change tack. Rates on easy-access accounts are starting to fall, while those on fixed-rate bonds are stable or rising.

So if you’re looking for a top rate and can lock your money away for a set period, you should consider moving some money across.

Investment trust discounts are nothing to be afraid of

As a new analyst, I was taught that one of the attractive features of investment trusts was the discounts: you can buy 100p of assets for 80p, and boost your returns when the discount closes.

This meant it was a surprise to meet managers for the first time and discover that many of them were embarrassed about trading on a discount.

More homebuyers to pay mortgage into old age, FCA data shows

Increasing numbers of home buyers will be paying their mortgage into their seventies, according to analysis of Financial Conduct Authority data.

A Freedom of Information request by wealth manager Quilter revealed a significant rise in the number of people taking out mortgages with a term of 35 years or more.

EasyJet boosted by lower fuel costs and strong package holiday demand

EasyJet slashed its first-quarter losses after the airline enjoyed falling fuel costs and flew more people during the Christmas season.

The FTSE 100 company reported its headline pre-tax losses slumped by 52 per cent to £61million in the three months ending December.

Government-backed online train ticket retailer to be launched

Trump plots to take a stake in TikTok as he threatens new tariffs

Donald Trump outlined plans to take a major stake in Tik Tok as he threatened China, Mexico and Canada with punishing tariffs and waged war on the global tax regime.

Within hours of his return to the White House, Trump flexed his muscles on the world stage by signing a flurry of executive orders and signalled an era of upheaval for the world economy.

Competition watchdog chief ousted as ministers bid to boost growth

Ministers have ousted the head of the competition regulator as they looks to cut red tape to boost economic growth.

Marcus Bokkerink, who became chairman of the Competition and Markets Authority (CMA) in 2022, will step down despite not completing his five-year term. Doug Gurr, former head of Amazon’s UK business and a director of the Natural History Museum, will replace him.

Wetherspoon’s flags £60m of extra labour costs under Budget plans

JD Wetherspoon has said its labour costs will increase by £60million a year from 1 April as a result of tax changes announced in Rachel Reeves’ Autumn Budget.

Businesses will be affected by a rise in employer national insurance contributions and the national minimum wage from April this year.

Boss Tim Martin warned that ‘Government-mandated wage increases’ have a ‘significantly bigger impact on pub and restaurant companies than supermarkets’.

Costs weigh in ‘lukewarm’ Christmas for JD Wetherspoon

Mark Crouch, market analyst at eToro:

‘Wetherspoons have served up a lukewarm trading update this morning after rising food and drink sales during the Christmas period were all but watered down due to the rising cost of operations. Despite coming off the back of a record year, the pub operator is facing significant pressure from increasing expenses which has led Wetherspoons’ chairman, Tim Martin, to publicly call out Sir Keir Starmer in the latest trading update, urging a resolution to the “tax discrepancy” surrounding the 20% VAT on food sales.

‘While Wetherspoons has a history of navigating economic challenges, shareholders may be concerned about the company’s performance in a record year as shares were down over 25% from their highs in 2024. This raises the question: If Wetherspoons is struggling now, what will it take—beyond government intervention—to reverse its fortunes? The company may need to consider raising prices, but with the risk of reducing demand, this is something they will likely want to avoid.

‘That said, Wetherspoons is taking proactive steps to address the challenges it faces. The focus on opening new pubs in high-performing areas, particularly major cities and travel hubs, is a sound strategy and in full flow. However, with costs rising, the company will need to become even more efficient in order to keep the wolves from the door.’

BlackRock agrees deal with Saba to protect its trusts from coup chaos

BlackRock has revealed an agreement with activist hedge fund Saba Capital it hopes will protect its London-listed investment trusta from the disruption faced by peers.

EasyJet on track for £10bn in sales

John Moore, senior investment manager at RBC Brewin Dolphin:

‘EasyJet’s results confirm good growth in sales and an improving picture in terms of profitability – even during the traditionally slower winter period.

‘This is a result of a number of measures coming together for the airline, such as route efficiency, lower fuel costs, and good load factors.

‘Unlike Ryanair, easyJet has a balanced fleet by manufacturer, so the Boeing dispute shouldn’t impact it unduly. That issue, and concerns about post-Budget consumer sentiment, appear to be the only clouds on the horizon – although, forward bookings are robust and the holidays business continues to deliver strong growth.

‘EasyJet should make £10 billion of sales this year and is en route towards £1billion in profits, which are significant milestones for the airline to reach in future updates.”

Netflix signs up a record 19m as crackdown on password sharing and raft of hit shows boosts business

‘Chancellor finds herself with even less fiscal headroom’

Joe Nellis economic adviser at accountancy and advisory firm MHA:

‘With public sector borrowing in December coming in higher than expected at £17.81bn, the Chancellor finds herself with even less fiscal headroom than previously thought.

‘Increased borrowing, combined with the recent rising cost of borrowing, has put more intense strain on central government expenditure.

‘While the bond market has calmed in the last week and fears of an emergency mini-budget have subsided, the Chancellor will be very aware of the dissipation of government finances as we head towards the OBR’s Economic and Fiscal Forecast scheduled for 26 March.’

EasyJet losses narrow

EasyJet saw operating losses narrow in its first fiscal quarter, as the airline was boosted by easing fuel costs, and strong demand for travel and its holiday packages.

Operating losses came in at £40 million for the three months to the end of 2024, compared with £117million a year earlier.

‘Looking to this summer, we have seen continuing demand for easyJet’s flights and holidays where we have one million more customers already booked, with firm favourites like Palma, Faro and Alicante,’ the carrier’s new CEO Kenton Jarvis said in a statement.

Showdown in the City: Legendary stock picker goes head-to-head with Wall St raider in battle over future of London’s investment trusts

Government borrowing hits £17.8bn in December

Government borrowing came in far higher than expected in December as a result of debt interest and a one-off purchase of military homes, data from the Office for National Statistics shows.

Public sector net borrowing of £17.8billion for the month exceeded market forecasts of £14.1billion and will put further pressure on Chancellor Rachel Reeves’ commitment to her fiscal rules.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.

This post was originally published on this site