By THIS IS MONEY

Updated: 05:34 EST, 15 January 2025

The consumer prices index dipped to 2.5 per cent in the year to December amidst falling hotel prices, according to the Office for National Statistics.

Among the companies with reports and trading updates today are Serco, Fuller’s, Currys, Hays, Vistry Group, and Frontier Developments.

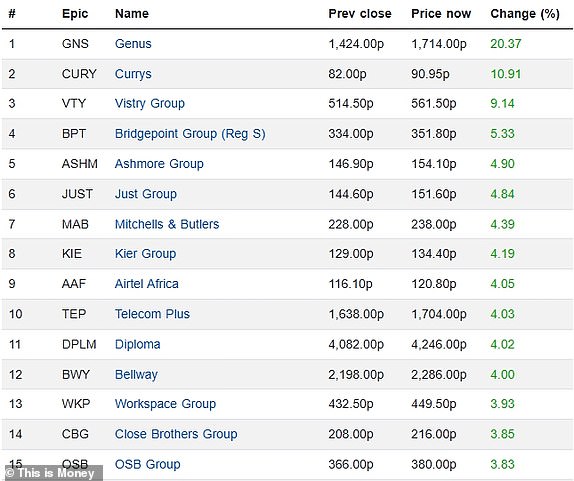

Genus shares top FTSE 350 risers

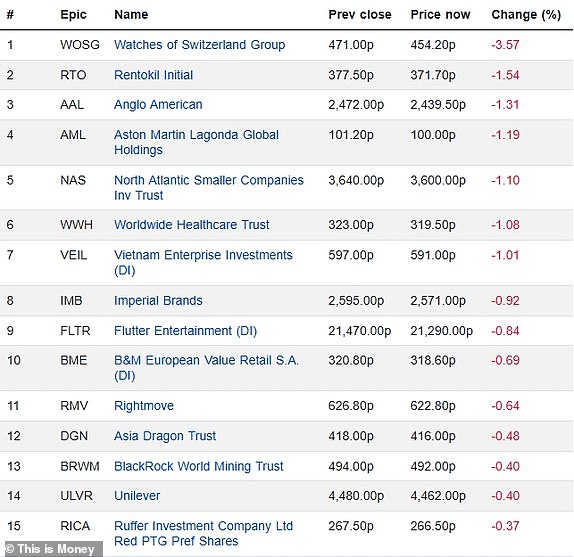

Watches of Switzerland shares top FTSE 350 fallers

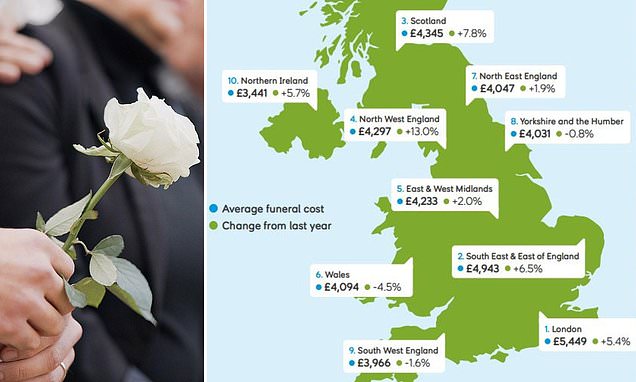

Basic funerals now cost £4,285 – but there is a cheaper option

The price of a basic funeral has hit a record £4,285, with increased burial and crematorium fees alongside staff wages driving up costs.

The average price has risen 3.5 per cent over the past year, pushing it above a previous pre-pandemic high of £4,194.

Currys ups profit outlook as customers snap up AI laptops and phones

Currys has upped its annual profit outlook after reporting a 2 per cent increase in underlying sales for the key Black Friday and Christmas trading period.

Currys shares rose 11.12 per cent or 9.12p to 91.12p on Wednesday, having surged more than 90 per cent in the last year.

CPI inflation falls to 2.5%: What happens next?

Inflation unexpectedly came in below expectations in December but remains above the Bank of England’s 2 per cent figure.

At its peak, inflation stood at 11.1 per cent. The latest ONS figures show that consumer prices index inflation fell from 2.6 per cent in November to 2.5 per cent in December.

Fiat slashes EV prices after recording a 14% decline in UK sales

Fiat has slashed the price of two of its electric models from January, having already reduced the cost of other battery cars in a bid to increase flailing demand that has seen the brand’s UK sales shrink by 14 per cent in the last year.

Prices tags for the 600e family crossover and Abarth 500e hot hatch have been trimmed by up to £4,220. Both now start from £29,975 in the hope it will make them more appealing to both private buyers and fleet customers.

Trump to take centre stage at Davos three days after his inauguration

Donald Trump will take centre stage at Davos next week when he delivers an address to the World Economic Forum.

The President will mark his return to the global stage when he appears virtually at the annual gathering of business and political leaders in Switzerland on Thursday – three days after his inauguration.

European and American regulators clear £3.6bn sale of Royal Mail

The sale of Royal Mail cleared another hurdle last night after European and American regulators approved a £3.6billion takeover.

International Distribution Services (IDS), which owns the postal service, said the deal has been cleared by the European Commission and the US Committee on Foreign Investment.

BP forced to delay crucial investor meeting as boss has surgery

BP has postponed a crucial investor meeting as its boss recovers from surgery amid falling profits and slowing production.

The FTSE 100 oil giant yesterday said it has delayed next month’s Capital Markets Day to allow chief executive Murray Auchincloss to recuperate after a ‘planned medical procedure’.

Elon Musk in talks to buy TikTok in the US

China is exploring a potential sale of TikTok’s US operations to Elon Musk for up to £41billion.

The social media platform, which has more than 2bn users globally, faces a ban in America on national security grounds.

Inflation drop ‘will be very welcome for the government’

Nicholas Hyett, investment manager at Wealth Club, comments on the latest fall in inflation:

The slowdown will be very welcome for the government. It increases the scope for the Bank of England to cut interest rates, boosting growth and lowering the cost of borrowing.

That would create a little more financial headroom for the Chancellor and reduce the need for substantial cuts to public spending.

However, we think there’s a significant risk that inflation kicks off again later in the year. Employers are set to start paying higher rates of National Insurance in April, pushing up labour costs.

That is likely to see prices rise in sectors like hospitality and retail that employ substantial numbers of people and wear margins are already pretty thin.

That risks sparking an inflationary spiral. It could be a tense few months as we wait and see how things play out.

US hedge fund Saba brands London trusts ‘a disaster’

The boss of the US hedge fund battling to win control of seven London-listed investment trusts has branded the sector a ‘disaster’ – and claims he is the ‘white knight’ needed to save it.

Saba Capital boss Boaz Weinstein said shareholders have lost out due to an ‘ecosystem of greed’ that has damaged the performance of UK trusts. He hit back at the mounting opposition to his plans to overhaul the trusts and replace their directors with his allies.

Inflation marginally falls

‘December’s dip in inflation won’t last long’

Thomas Pugh, economist at RSM UK, comments on the latest UK inflation figures:

December’s dip in inflation won’t last long. The combination of firms passing through the large increase in labour costs imposed by the budget, increases in taxes and rising energy prices means inflation will breach 3% in the Spring, forcing Governor Bailey to pen his first letter to Rachel Reeves.

The tick down in inflation in December does raise the chances of a rate cut in February, but rising inflation this year means the Bank of England will cut rates cautiously.

Inflation rate drops from 2.6% to 2.5%

Embattled Rachel Reeves was offered a surprise respite today as inflation unexpectedly dipped.

The headline CPI rate slid to 2.5 per cent in December from 2.6 per cent the previous month, with core inflation also slowing.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.

This post was originally published on this site