Friday, Socialist Vermont Senator Bernie Sanders used a post on X, the social media platform formerly known as Twitter, to announce that he was willing to work with the incoming Trump administration to accomplish mutually beneficial legislation.

Advertisement

I look forward to working with the Trump Administration on fulfilling his promise to cap credit card interest rates at 10%.

We cannot continue to allow big banks to make record profits by ripping off Americans by charging them 25 to 30% interest rates.

That is usury.

— Bernie Sanders (@SenSanders) November 15, 2024

I look forward to working with the Trump Administration on fulfilling his promise to cap credit card interest rates at 10%.

We cannot continue to allow big banks to make record profits by ripping off Americans by charging them 25 to 30% interest rates.

He received a quick reply from Missouri Republican Senator Josh Hawley. “An anti-usury bill capping outrageous credit card rates,” said Hawley, “ought to be a top priority of the next Congress.”

An anti-usury bill capping outrageous credit card rates ought to be a top priority of the next Congress https://t.co/rPGfSEgVsB

— Josh Hawley (@HawleyMO) November 16, 2024

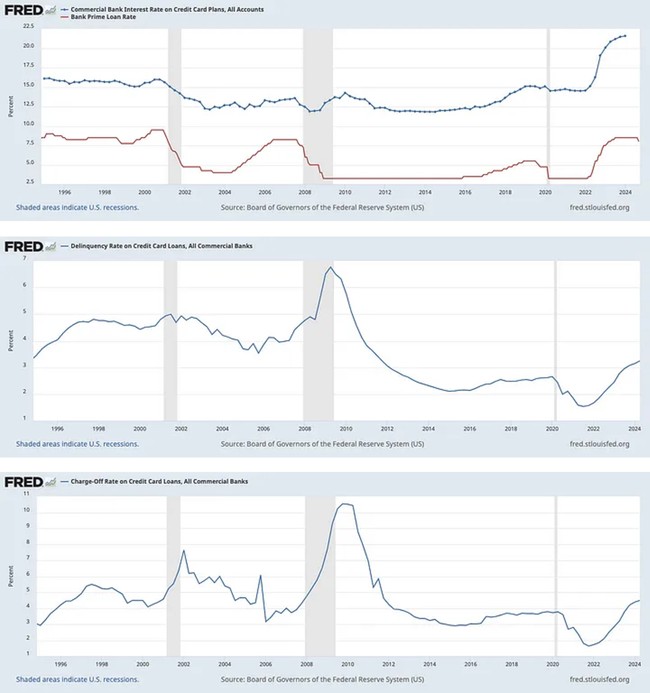

According to data from the US Federal Reserve, credit card interest rates the average credit card interest rate is now at an all-time high, while delinquencies and charge-offs are within the range of historical norms. So, it would seem that profit is a motive.

Sources:

Net Percentage of Domestic Banks Tightening Standards for Credit Card Loans. Source: https://fred.stlouisfed.org/series/DRTSCLCC#

Advertisement

Delinquency Rate on Credit Card Loans, All Commercial Banks. Source: https://fred.stlouisfed.org/series/DRCCLACBS#

Charge-Off Rate on Credit Card Loans — All Commercial Banks. Source: https://fred.stlouisfed.org/series/CORCCACBS

Capping credit card interest has been an interest of Hawley’s for over a year. Sticking it to the man has been Sanders’s battle cry since Methuselah was a baby. Donald Trump picked up the call for equity in interest rates at a rally in September.

Former President Donald Trump has made headlines over the past week with yet another surprise economic policy announcement. After promising free in vitro fertilization treatments for women, no federal income tax on tips, tax-free overtime pay and no income tax on Social Security benefits, Trump now says that if he is elected president in November, he will cap credit card interest rates at around 10%.

“While working Americans catch up, we’re going to put a temporary cap on credit card interest rates,” the Republican presidential nominee said at a rally in New York on Wednesday. “We can’t let them make 25% and 30%.”

Even if we go full-metal Elizabeth “High Cheekbones” Warren and agree that it is up to Daddy Government to save stupid consumers from themselves, is a cap on credit card interest the way to go?

Advertisement

In my view, the number of times the government has intervened in markets directly and produced the intended result can probably be counted on the fingers of one hand. The obvious problem with a return to the medieval system of slapping usury laws on lenders is that when interest rates spike, banks lose the ability to adjust their interest rates. This, by definition, creates a drought in the credit market, which is quickly felt by commercial enterprises that rely on credit card transactions. If one is hellbent on regulating credit cards to save people from themselves, then allow a certain rate against the Fed’s bank rate.

The sad fact is that laws like this have one effect, and it is not protecting people with low incomes from predatory lenders. Years ago, the Fed sponsored a study of the impact of usury ceilings:

Economic research clearly supports the current legislative moves toward deregulation of usury ceilings. The evidence on the impact of usury ceilings shows that they have not achieved their objectives. According to the empirical studies surveyed, usury ceilings have significantly reduced the availability of credit and created hardships for those who were supposed to be protected. Ceilings have encouraged lenders to use credit rationing devices such as higher down payments, shorter maturities, higher fees for related non-credit services, which increase the effective interest rate. They have curtailed the amount of credit available to lower income and higher risk borrowers, harming primarily those individuals whom the ceilings are intended to benefit. Finally, the lack of uniformity in usury laws across states has distorted credit flows and economic activity, favoring those states and regions which are less regulated.

Advertisement

What is worse, a guy holding a credit card that carries a 30% interest rate or his car breaking down and losing his job because he can’t get to work all due to some well-meaning Karen in DC deciding it is more virtuous for him to be destitute than enrich some bank?

Trump needs to back off faux-populist issues like this. I understand the sugar rush of applause as well as the next guy, but cutting off credit card access from banks doesn’t mean that poor people won’t pay exorbitant interest rates.

How much does a payday loan cost?

Many state laws set a maximum amount for payday loan fees, ranging from $10 to $30 for every $100 borrowed. A typical two-week payday loan with a $15 per $100 fee equates to an annual percentage rate (APR) of almost 400 percent. By comparison, APRs on credit cards can range from about 12 percent to about 30 percent. In many states that permit payday lending, the cost of the loan, fees and the maximum loan amount are capped.

What we are seeing here is the beginning of a bipartisan effort that will end up like all bipartisan efforts. In this case, lower-income people will be deprived of a source of ready credit and forced to leave the formal banking system to find it. Banks will crank up fees and keep their profit margins to exactly where they are today, and both sides on Capitol Hill can send out a barrage of press releases on the triumph of bipartisanship.

Advertisement

We have two parties here, and only two — one is the evil party, and the other is the stupid party. I’m very proud to be a member of the stupid party. Occasionally, the two parties get together to do something that’s both evil and stupid. That’s called bipartisanship..