- Commonwealth Bank ditches December rate cut call

The Commonwealth Bank is now advising borrowers to ditch their hopes of a rate cut by Christmas despite a big fall in inflation.

Headline inflation – known as the consumer price index – fell to a three-year low of 2.8 per cent in September.

This was a big drop from the June quarter’s annual pace of 3.8 per cent, based on one-off $300 electricity rebates and a sharp fall in petrol prices to $1.80 a litre.

The CPI is now right between the Reserve Bank of Australia’s 2 to 3 per cent target for the first time since March 2020.

Inflation since the pandemic has been very volatile, diving below target during lockdowns, only to surge later to three-decade highs as a result of supply constraints and pent-up demand for services.

This meant headline inflation during the September quarter, with volatile price items included, was at the lowest level since the March quarter of 2021 when Melbourne was in lockdown.

But the Commonwealth Bank’s head of Australian economics Gareth Aird has revised his forecast to have the RBA now cutting rates in February instead of December, when one-off factors were excluded from the inflation numbers.

‘The upshot is that we no longer expect the RBA to cut the cash rate in December 2024,’ he said.

‘Instead we pencil in February 2025 for a 25 basis point rate decrease.’

The Commonwealth Bank, Australia’s biggest home lender, has revised its forecast because underlying inflation – also known as the trimmed mean – was still too high at 3.5 per cent, down from 4 per cent.

This measure excludes volatile price items – like petrol, fruit and vegetables and electricity rebates – to get an average increase in consumer prices.

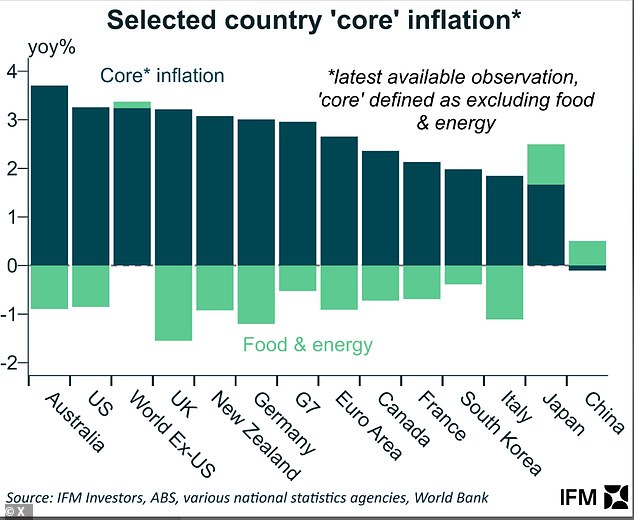

An IFM Investors chart, published on Wednesday, also showed Australia’s underlying inflation to be higher than equivalent core inflation levels in the US, UK, New Zealand, Canada and the European Union which have this year all cut interest rates – albeit from higher levels than Australia.

Another underlying Australian inflation measure, known as the weighted median, produced an even higher reading of 3.8 per cent.

This also excludes volatile items to find a middle increase in prices for more commonly sought-after goods and services.

The Australian Bureau of Statistics quarterly inflation data, released on Wednesday, also showed services inflation soaring by 4.6 per cent in the year to September as goods inflation edged up by a lesser 1.4 per cent.

CBA has now joined the other Big Four banks – ANZ, Westpac and NAB – in predicting a quarter of a percentage point rate cut in February.

This would see the RBA cash rate fall to 4.1 per cent for the first time since November 2023, when rates rose for the 13th time since May 2022.

The 30-day interbank futures market is now less excited, forecasting three rate cuts in 2025 instead of four, as recently predicted.

This would take the cash rate from an existing 12-year high of 4.35 per cent down to 3.6 per cent for the first time since May 2023.

A borrower with an average, $636,208 mortgage would see their monthly repayments fall by $309, adding up to $3,708 a year in savings.

While headline inflation looks good, the lower number was based on one-off factors like the federal government’s $300 electricity rebate for 2024-25 and Queensland’s $1,000 rebate on top of that.

The Reserve Bank is universally expected to leave interest rates on hold on Tuesday next week.

Governor Michele Bullock is set to announce a decision at 2.30pm, Sydney time, half an hour before the Melbourne Cup.

As Australia focuses on a horse race, she will be holding a media conference at 3.30pm.