OAN Staff James Meyers

1:53 PM – Wednesday, November 27, 2024

The Dow Jones Industrial Average hit a new record high, topping 45,000 for the first time and making a run for its 47th record close, before falling on Wednesday afternoon.

The Dow fell after the PCE Inflation report was released, according to Barron’s. Barron’s is a financial magazine and website that provides market commentary, news, and insights for investors.

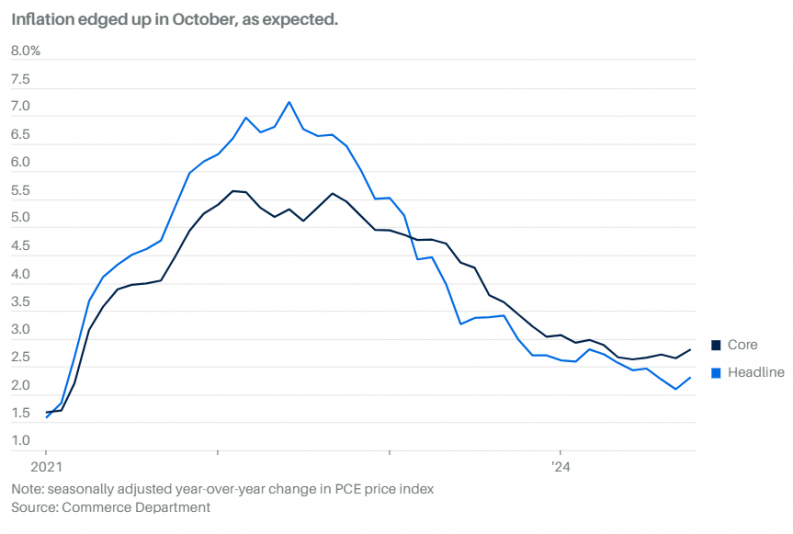

Data showed consumer spending increased in October, with analysts claiming that the economy maintained its strong pace of growth early in the fourth quarter. However, progress on lowering inflation appears to have stalled in the past months.

Traders added to bets that the Federal Reserve will lower borrowing costs by 25 basis points at its December meeting, according to CME’s FedWatch.

Many anticipate that the central bank will leave rates unchanged at its January and March meetings.

Dell and HP dropped 10.5% and 10.1%, after plummeting quarterly forecasts took effect on the Information Technology sector, which led to sectoral declines.

This caused it to spread to mega caps, such as Nvidia and Microsoft, which dropped 3.5% and 1% respectively, while the Philadelphia SE Semiconductor Index slid 3.2% to hit a more than two-month low.

“Inflation has proven to be a little stickier than the Fed would have liked, which may give them pause with respect to cutting rates,” said Scott Welch, chief investment officer at Certuity.

“There are questions around the effects of Trump’s stated tariff policy, which, if implemented could be pretty inflationary and so the Fed is going to have to balance itself between the economic data and the incoming administration’s policy agenda.”

Additionally, policymakers have been uncertain about the outlook for interest-rate cuts and how much the current rates were restricting the economy.

Meanwhile, the S&P 500 is on track for its biggest one-month rise in a year and its sixth month of gains out of seven, as markets price in the probability of Trump’s policies benefiting local businesses and the overall economy.

Furthermore, Workday lost 7.7% after forecasting fourth-quarter subscription revenue below expectations.

Stay informed! Receive breaking news blasts directly to your inbox for free. Subscribe here. https://www.oann.com/alerts