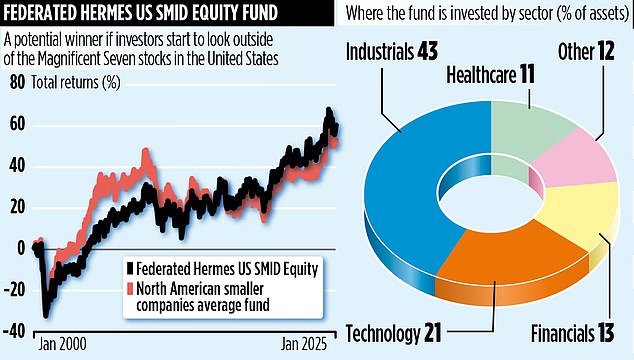

Investment fund Federated Hermes US SMID Equity goes under the radar of most investors wanting exposure to the US stock market.

Like many other US smaller companies’ funds, it often gets the cold shoulder because it doesn’t invest in the Magnificent Seven tech stocks that have been responsible for so much of the stellar returns from US equities over the past couple of years.

Yet fund manager Mark Sherlock is not fazed by his fund being somewhat in the shadows.

‘Does the future look like the past?’ he asks. ‘No,’ is his answer.

Are the valuations of the companies that he sets his sights on more compelling? ‘Yes,’ according to the financial numbers. Cheap as chips when compared to the current valuations of the Magnificent Seven – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla.

‘The market we trawl for investment ideas is ignored by many investors,’ says Sherlock. ‘But it’s exciting and, with Donald Trump about to unleash a set of proposals to turbocharge the US economy, the domestic stocks we favour could do well.’

Federated Hermes US SMID Equity is a £1.1 billion fund that invests outside the Standard & Poor’s Index, which comprises the 500 largest listed companies in the United States. Its trawling ground is the Russell 2500 Index, the small to mid-cap universe of the US stock market.

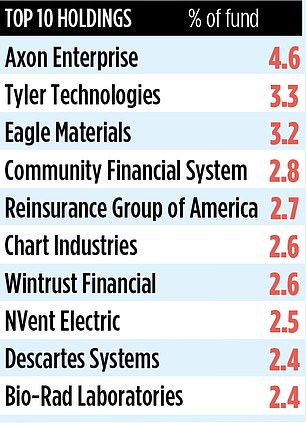

Of the 2,500 stocks, Sherlock and his team exclude companies that are loss-making or early-stage tech. It’s left with about 800 businesses, a quarter of which end up on a ‘watch list’. Around 50 then make it into the portfolio.

‘We like companies that have durable competitive advantage over their rivals,’ explains Sherlock. This could be a result of a company either having a patent on a product – making it difficult for competitors to challenge them – or controlling a big slice of a particular sector.

For example, the fund is a long-term investor in aggregates supplier Martin Marietta Materials (MMM), which owns one of the largest rock quarries – Beckmann – in the state of Texas. Like a number of fund holdings, MMM is now part of the S&P Index.

Sherlock says: ‘We don’t automatically sell companies that make it into the S&P but we do exit them over time so that we do not betray the ‘SMID’ [small to mid-cap] focus of the fund.’

Many of the stocks targeted by the fund are not well covered by analysts in the United States. This makes it easier for Sherlock and his team to find investment opportunities overlooked by others.

Although based in London, one of the six-strong team are in the United States every three weeks visiting companies the fund is invested in – or interested in.

Companies also visit them with Sherlock saying: ‘We run one of the largest US small to mid-cap franchises in London.’

The fund’s performance numbers are solid both on an absolute and relative basis. Over the past one and five years, it has generated total returns of 21.1 and 64 per cent respectively. Over the same time periods, the average US smaller companies fund has delivered 21.8 and 54.3 per cent, respectively.

Sherlock says he sees the fund as ‘more of a tortoise than a hare’, quietly building long term returns for investors. ‘It’s a sleep at night portfolio, a diversifier,’ he adds.

‘It’s the result of a decade and a half spent crawling all over the small to mid-cap space in the quest for long-term winners.’

Annual charges total 1.59 per cent. Other US smaller companies’ funds worth considering include those run by Artemis, Columbia Threadneedle and T Rowe Price.

DIY INVESTING PLATFORMS

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.