- Labor vows no regional bank closure before July 2027

The federal government has announced a two-year moratorium on regional bank branch closures as concerns grow about the future of cash in Australia.

Just 13 per cent of transactions are now being done in cash and Linfox Armaguard, Australia’s biggest cash delivery company, fears it may be unprofitable to continue transporting banknotes beyond 2026.

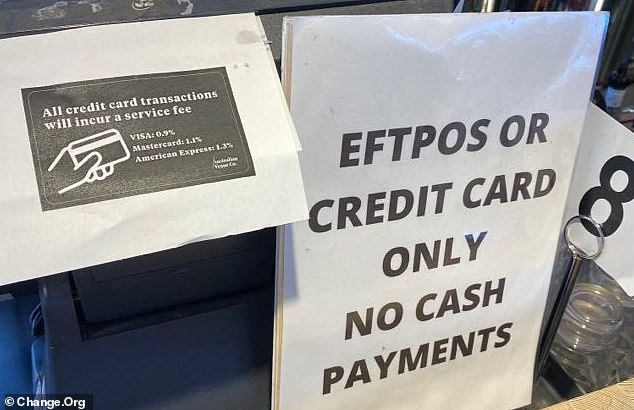

Anthony Albanese‘s government announced a cash acceptance mandate in December which makes it an offence for businesses to refuse cash payments.

Australians have until this Friday to make a submission to Treasury’s Mandating Cash Acceptance consultation paper.

Jason Bryce, a campaigner to keep cash, has attracted 200,000 signatures on a change.org petition calling on the government to guarantee all Australian towns and communities had access to banking services.

‘No Australian town, suburb or community should be left without reasonable local access to full banking services and physical notes and coins,’ he said.

‘Every Australian must be able to use cash to buy food and groceries if they choose.’

Treasurer Jim Chalmers on Tuesday announced a deal had been reached with the major banks to put a stop to any further regional bank branch closures before July 2027.

‘This is all about making sure that banks stay open in the bush,’ he told reporters in Canberra.

Dr Chalmers and Communications Minister Michelle Rowland highlighted how 36 per cent of bank branches in regional areas had closed since 2017.

A closer look at figures from the Australian Prudential Regulation Authority showed 847 branches in regional and remote parts of the country had closed since June 2017.

Nationwide, 2,335 branches had closed in both capital cities and regional areas over seven years; a 41 per cent reduction.

Australia Post has reached agreements with the Commonwealth Bank, NAB and Westpac to enable customers to do their banking at one of 4,000 local post offices.

ANZ has agreed to key terms on that deal, while Macquarie and HSBC have agreed to begin negotiations about joining the Bank@Post service.

Australian Banking Association chief executive Anna Bligh suggested fewer Australians were likely to visit bank branches in coming years.

‘As we see more and more Australians jump online to do their banking, we are going to see a continued digital transformation,’ she said.

‘Our job collectively is to make sure we don’t leave any Australian behind as that transformation accelerates, and that’s what today’s announcements will do.’

Mr Bryce is urging Australians to make submissions to the cash mandate consultation during the next three days.

‘You can write anything you like in your submission,’ he said.

‘You should explain, firstly, why cash is important to you and how you use cash.

‘There should be few if any exemptions granted from the cash mandate.

‘Australians expect that their legal tender is accepted everywhere; the law needs to reflect this expectation.’

Dr Chalmers last year wrote a foreword to Treasury’s consultation paper promising a cash mandate ‘for essential purchases, such as groceries and fuel’ so ‘those who rely on cash will not be left behind’.

A Reserve Bank of Australia paper published in January said cash was still important, particularly to the elderly and the poor.

‘Older Australians and people on lower incomes are more likely to use cash for a high share of their transactions, and some high cash users may have few alternative methods of payment available to them,’ it said.

Campaigners for cash have also put forward privacy arguments, allowing some payments not to be recorded in the way electronic payments are, plus the need to have a back-up if payment systems can’t operate through technological or electricity failure.