Stock market investors have been denied a so-called Santa Rally in the closing stages of 2024, having weathered yet another year dominated by geopolitical turmoil and macroeconomic headwinds.

High-flying tech stocks have been among the few companies to advance over the course of December, reflecting a year in which artificial intelligence has proved a dominant market theme.

Investors have turned more bearish over the last month, as global growth fears have gripped the UK, the US, Europe and China.

The US Federal Reserve helped spark the worst week for stock markets since early September last week as the Fed struck a more hawkish interest rate tone, despite cutting for the third consecutive meeting.

Markets now expect just two Fed interest rate cuts next year, as opposed to the four cuts guided in the central bank’s September meeting.

US markets slumped in response, having been propelled higher the prior month, as the election of Donald Trump for a second term as President raised hopes of a more accommodative business environment

Chief investment officer at Magnus FDM, Rory McPherson said: ‘The Federal Reserve took on the role of stock market grinch last week! Whilst they delivered on a much-anticipated interest rate cut (which takes their rate cuts to a full 1 per cent this year), there was a cautious tone to their outlook which weighed on stocks and bonds.’

He added: ‘The more cautious tone from the US Fed set the tone for the market last week, but it is worth noting that US economic data (which, along with earnings growth, has driven this bull market) came in very strong.

‘Third quarter US growth data (GDP) got revised up to 3.1 per cent (from 2.8 per cent), with personal consumption (which drives US growth) getting revised up to 3.7 per cent (from 3.6 per cent).

‘Furthermore, US core Personal Consumption Expenditure (the Fed’s preferred measure of inflation) came in below expectations at a yearly run rate of 2.8 per cent.’

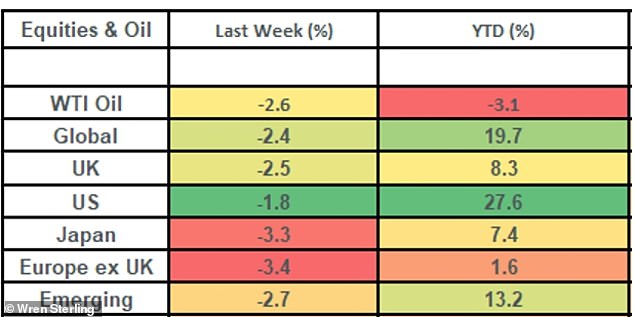

How major markets have performed

The S&P 500 and Dow Jones are down by 0.9 and 4.2 per cent respectively over the last month as a result, while the dominance of the global tech giants has helped the Nasdaq gain 2.7 per cent for the month.

The Nasdaq has soared 33 per cent since the start of the year, while the S&P 500 and Dow Jones have added 25 and 23.6 per cent, respectively.

US markets have generally outperformed global peers this year as the American consumer continues to power the economy.

By contrast, the FTSE 100 and FTSE 250 have slipped 2.3 and 1.6 per cent lower over the last month, limiting 2024 gains to an uninspiring 2.3 and 1.6 per cent respectively.

Like in the US, expectations for the scale and pace of the Bank of England’s interest rate cutting cycle have also fallen back heavily amid persistent inflationary pressures. Markets currently expect two or three cuts next year.

Unlike in the US, however, UK economic data has gone from bad to worse in recent months.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, said: ‘There’s not much merriment around for the UK’s economic prospects as the latest assessment from the ONS paints a picture of stagnation.

‘The long period of speculation prior to Rachael Reeves announcements is unlikely to have helped, given the rumour mill was running on overdrive.’

Similar growth woes have hit also hit the eurozone, with the Stoxx Europe 600 adding just 5.2 per cent for the year,

Meanwhile, waves of Chinese government stimulus have helped to calm markets as ructions in the country’s all-important property sector have sent shockwaves through the broader economy.

China’s CSI 300 Index is up 2.2 per cent over the last month, taking 2024 gains to 16.16 per cent, after officials said Beijing would ‘implement more proactive fiscal policies and moderately loose monetary policies’.

Justin Thomson, head of international equity at T. Rowe Price, said: ‘The world will likely need to get used to a structural downshift in China from the 5 to 6 per cent growth rates seen over the past few decades.

‘A further challenge to Chinese growth may come if Trump delivers on his promise to impose more tariffs on China.

‘In the meantime, the combination of compressed valuations, bottom-up innovation, and the potential for strong countertrend rallies means that opportunities to invest in China will continue to arise.’

DIY INVESTING PLATFORMS

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.