Two more investment trusts have fought off a takeover attempt by a Wall Street raider as he failed again to drum up support for his plans.

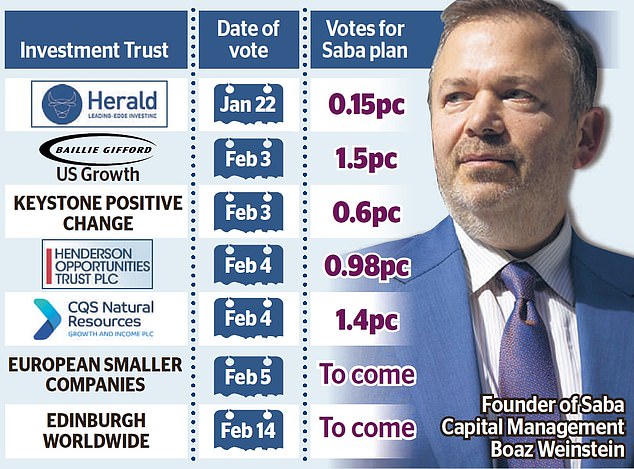

Shareholders in the Henderson Opportunities and CQS Natural Resources Growth and Income trusts decisively rejected proposals by Boaz Weinstein’s firm Saba Capital to oust their boards and replace them with its own nominees.

The American hedge fund tycoon has been defeated by five of what he has dubbed the ‘miserable seven’ trusts he targeted in a showdown that has raised serious questions about the future of the industry.

Of the remaining two firms, the European Smaller Companies trust faces a vote from shareholders later today. The Edinburgh Worldwide trust is due to meet on Valentine’s Day.

Another two defeats would mark a humiliation for Weinstein, 52, who has accused the boards and management of the seven trusts of failing shareholders, insisting he could do better.

But his move – even if it turns out to be unsuccessful – has cast a light on the performance of the London-listed investment trust sector and piled pressure on the industry to raise its game.

Saba built stakes in each firm, ranging from 19pc to 29pc and called meetings to ask other shareholders to approve his plans. It was feared a low turnout by private investors would pave the way for the hedge fund to succeed.

But in a victory for the Mail – which has highlighted the issue and urged investors to have their say – broker Hargreaves Lansdown reported record turnout among customers on its platform earlier this week.

At Henderson Opportunities yesterday, more than 99 per cent of votes that were not cast by Saba opposed its proposals.

Overall, shareholders voted 65.6 per cent against the plans compared to just 34.4 per cent in favour. Turnout for the vote was 73.4 per cent of eligible shares.

Meanwhile at CQS, more than 59 per cent rejected the proposals compared to 40.9 per cent in support.

Of the non-Saba shares, only 1.4 per cent supported the US firm’s agenda. Turnout stood at 68.3 per cent.

‘The result shows that shareholders do not want to be part of a Saba managed vehicle,’ said Henderson Opportunities chairman Wendy Colquhoun.

CQS chairman Christopher Casey said: ‘The strong vote speaks loud and clear.’

On Monday, the Baillie Gifford US Growth and Keystone Positive Change trusts voted down Weinstein’s plans for a boardroom overhaul.

Two weeks ago, the Herald Investment Trust, the largest fund on Saba’s hit list, also crushed plans to oust its directors.

DIY INVESTING PLATFORMS

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.