How kind it would be on our pockets if the High Street did a ‘Rick Stein’ and charged us 1975 prices for a wee while (four days in Rick’s case). We’d be laughing all the way to the bank – if we could find one still open.

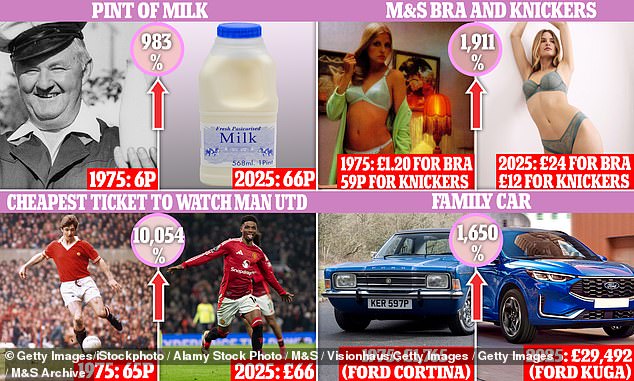

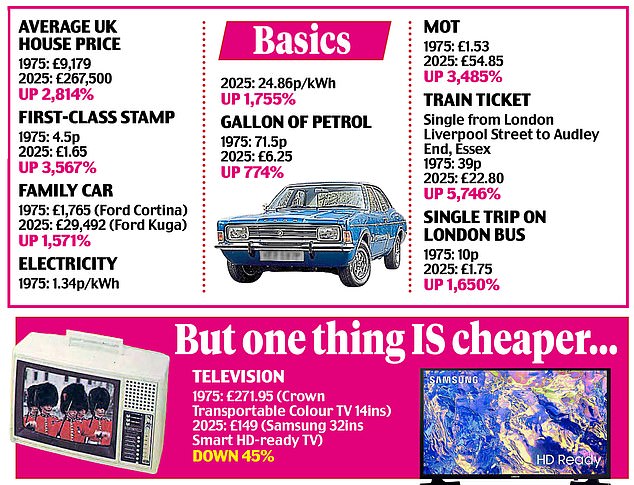

A pint of milk for just six pence, compared to the 65p we now pay for a British whole variety. Then 83p for a pound of sirloin steak compared to the £13 you pay at Tesco’s (‘finest’ naturally). And fish and chips, wrapped in newspaper, for 35p.

Although life 50 years ago was far less expensive in absolute monetary terms, I wouldn’t want to be thrown back in time.

While my memory is not as sharp as it was when a teenager growing up in Birmingham, I do remember that life in the Prestridge household wasn’t without financial challenges.

For us, a family of six, sirloin steak was off the menu and offal all over it. That meant tripe sandwiches, liver, kidney, and if Dad was cooking, heart. Part because it was the food Mum and Dad grew up on, part a result of challenged household finances.

Clothes weren’t thrown away but patched up, while shoes were worn into the ground.

As for overseas holidays, they were as rare as hen’s teeth – a caravan in Tenby, South Wales was standard fare.

As a youngster interested in politics and economics, I also remember that 1975 was a car wreck economically (yes, you guessed correctly, Labour was in power).

Inflation was rampaging towards 25 per cent, enabling powerful unions such as the National Union of Mineworkers to get block-busting pay rises for members, while unemployment broke through one million. Worse than Labour 2025, but then it’s still early days for Ms Reeves and Sir Keir Starmer.

Although some items have become cheaper in relative terms such as air travel – thank you Ryanair and easyJet – life is now more expensive. And in recent years, the wrecking ball of inflation triggered by the war in Ukraine is largely to blame.

Energy bills remain resolutely high. Yet the demands on household income are as much a reflection of the march of consumerism than relentless price rises.

Our propensity to spend is fuelled by a stream of new gadgets, easy credit, keeping up with the Joneses, convenience (online shopping and home delivery) and the persuasive advertising of global brands.

Fifty years ago, you were part of the in-crowd if you owned a colour TV. For most people, the only way to watch TV was to rent one. Today, few family homes are without at least one TV (flat screen and as big as your wall will take) with subscriptions to sports and film channels.

Broadband, mobile phones and home computers are all deemed essential, while two-car families are par for the course. Dining out is a given, while it’s nigh impossible to walk down the High Street without being tempted by an overpriced cup of coffee.

Many of us spend too much because we are overwhelmed by temptation. This was confirmed to me during lockdown when my spending fell off a cliff and I saved like never before.

There’s a halfway house between these extremes of excessive and essential-only spending, which is the way forward. I’m desperately searching for it.