- This is Money’s long-running mortgage rates round-up looks at the best deals and what you need to consider when looking for a home loan

- Check the top deal for your situation with our mortgage calculator tool

Mortgage rates are heading higher once again, with big lenders now reversing some of the cuts made in recent months.

Last week, a number of major high street banks upped their fixed rate mortgages. It is no longer possible to get a sub 4 per cent mortgage rate with a major lender.

The higher mortgage raes come despite the Bank of England cutting interest rates earlier this month from 5 per cent to 4.75 per cent.

Market expectations about how quickly and low interest rates will fall in future have shifted of late – and this is having a direct impact on fixed rate mortgage pricing.

In the topsy turvy market, this comes at the same time as the Bank of England base rate cuts have led banks and building societies to cut standard variable rates.

We explain what’s happening to mortgage rates, where they are forecast to head next and what to consider if you need to fix soon.

> Best mortgage rates calculator: Check the deals you could apply for

Mortgage rates: what is happening

Mortgage rates have come down this year, as the Bank of England has shifted to cutting the base rate and lenders expect interest rates will continue to fall.

Interest rates have fallen by 0.5 percentage points since August, down from a high of 5.25 per cent to 4.75 per cent in November.

Between the start of July and October, the lowest five-year fixed rate mortgage fell from 4.28 per cent to 3.68 per cent. Meanwhile, the lowest two-year fix fell from 4.68 per cent to 3.84 per cent.

But the lowest rates are now higher at 4.14 per cent and 4.21 per cent, respectively, as rates have crept higher again with some of the best sub-4 per cent deals disappearing.

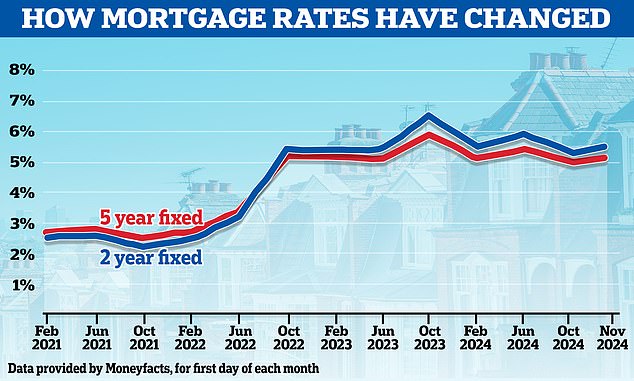

Nonetheless, mortgage rates remain well below their recent peak.

In 2023, a combination of base rate hikes and worries over inflation figures saw average two-year fixed mortgage rates reach a high of 6.86 per cent in the summer, according to Moneyfacts, while five-year fixed rates hit 6.35 per cent.

But with the rate of inflation falling back and the Bank of England first holding and now cutting interest rates, mortgage rates have also reduced.

That said, mortgage rates still remain far higher than borrowers had enjoyed prior to the surge in 2022.

Less than three years ago, the averages were hovering around 2.5 per cent for a five-year fix and 2.25 per cent for a two-year.

In fact, as recently as October 2021, some of the lowest mortgage rates were under 1 per cent.

Will mortgage rates go down?

Mortgage borrowers on fixed rate deals should worry less about where the base rate is today, and more about where markets think it will go in the future.

This is because banks tend to pre-empt base rate movements. Lenders change their fixed mortgage rates on the back of predictions about how high or low the base rate will ultimately go and how long it will stick there.

Last year, forecasts for where the base rate would eventually peak fell from a high of 6.5 per cent to 5.25 per cent, mortgage rates shifted with this.

At the start of this year, markets were pricing in six or seven base rate cuts in 2024, with investors betting on rates falling to 3.75 per cent or 3.5 per cent by Christmas.

They have since rowed back on this. Investors are now forecasting that there will only be three or four interest rate cuts between now and the end of 2025, to 4 per cent or 3.75 per cent.

Even this has shifted over the past month, as Labour’s Budget plan to borrow and spend more has slightly troubled government debt markets, sending interest rate expectations and gilt yields higher.

Mortgage pricing: a rough guide

Mortgage market expectations are reflected in something known as Sonia swap rates.

These are agreements in which two counterparties, for example banks, agree to exchange a stream of future fixed interest payments for a stream of future variable payments.

Mortgage lenders enter into these agreements to shield themselves against the interest rate risk involved with lending fixed rate mortgages over a period of time.

For example, if a bank lends a mortgage fixed for five years, it wants to have some certainty on what it will cost to fund that over the time period, rather than being dependent on shifting interest rates and potentially being caught out by big unexpected moves.

Put simply, swap rates show what financial institutions think the future holds concerning interest rates.

As of 14 November five-year swaps were at 4 per cent and two-year swaps were at 4.22 per cent – both trending well below the current base rate.

However, this is higher than a month ago when five-year swaps were at 3.74 per cent and two-year swaps were at 3.98 per cent.

In contrast, that is a lot lower than it was during the summer of 2023 when five-year swaps were above 5 per cent and two-year swaps were coming in at around 6 per cent.

This highlights quite how much interest rate expectations can shift around and how unreliable forecasts can be.

Why did mortgage rates go up?

Mortgage rates first began to increase towards the end of 2021, when inflation started to rise, resulting in the Bank of England increasing base rate to try and combat it.

The Bank uses the base rate to try to keep inflation to its 2 per cent target. The aftermath of the Covid lockdowns, combined with Russia’s invasion of Ukraine in February 2022, triggered a huge inflation spike. Central banks were caught on the hop and rushed to try to rein this in with higher interest rates.

Mortgage rates accelerated after the Liz Truss-Kwasi Kwarteng mini-Budget in late September 2022. The pound tumbled after Kwarteng, announced a wave of unfunded tax cuts that unsettled bond markets.

After Truss resigned in October 2022, new Chancellor Jeremy Hunt reversed nearly all of the mini-Budget announcements. The markets calmed down and the cost of borrowing fell with mortgage rates dropping too.

But following a fresh round of stubbornly high inflation figures in late spring 2023, markets began betting the base rate would peak at 6.5 per cent.

This triggered a summer inflation panic and led to mortgage lenders whacking their rates up again.

Once the inflation worries subsided, interest rate expectations eased substantially but inflation proved stickier than expected in 2024 and the Bank of England ended up holding base rate at 5.25 per cent.

With inflation finally returning to its 2 per cent target, the Bank finally felt comfortable cutting rates to 5 per cent at its August 2024 meeting.

The most recent reading from the ONS showed inflation at 1.7 per cent in September. Base rate was cut again to 4.75 per cent by a vote of 8 to 1 at the November Monetary Policy Committee meeting.

Most economists and personal finance experts think the Bank of England will proceed cautiously from here.

Laith Khalaf, head of investment analysis at AJ Bell said: ‘The market is still pricing in another rate cut either in December or February, and then another one by May 2025.

‘There are some more bullish voices out there, including Goldman Sachs who have forecast UK base rate to fall to just 2.75 per cent by next Autumn.

‘The fact the decision to cut rates was almost unanimous will put some powder in this argument.’

> Five crucial Bank of England charts on interest rates and inflation

What will happen to house prices?

House prices have hit a new high, according to Halifax, surpassing the previous peak set in June 2022 during the pandemic property boom.

The price of the average home rose for the fourth month in a row in October, according to the bank, which bases its figures on its own mortgage applications.

The typical property edged up by 0.2 per cent over the month, while year-on-year prices rose by 3.9 per cent.

It means the average property price has reached a record high of £293,999, surpassing the previous peak of £293,507.

Tom Bill, head of UK residential research at property firm Knight Frank thinks higher mortgage rates could potentially drag prices lower again.

‘The interest rate landscape has become more adverse than a fortnight ago, which will increase downwards pressure on house prices in the short-term.

‘For now, anyone deciding whether to fix for two or five years must consider whether they think Labour’s revenue-raising plans will work or more rate turbulence lies ahead during this Parliament’

What next for interest rates?

Starting in December 2021, the Bank of England attempted to combat rising inflation by aggressively upping interest rates. In the space of just 20 months, base rate went from its record low of 0.1 per cent to its recent peak of 5.25 per cent, reached in August 2023.

At that point rate hikes stalled and gradually sentiment on inflation shifted.

Now the central bank is keeping a keen eye on inflation, but also looking out for any disinflationary factors, such as an uptick in unemployment or downturn in economic growth.

The most bullish forecasters on rate cuts have base rate coming down to as low as 2.75 per cent by the end of 2025, with Goldman Sachs analysts announcing this rate forecast recently.

At the more reserved end of the spectrum, Santander recently revealed it expects interest rates to fall to 3.75 per cent by the end of next year.

Meanwhile, economists at Capital Economics think the base rate will fall to 3.5 per cent by early 2026.

They had previously forecast that interest rates would fall to 3 per cent by the end of next year, but have concluded that rates will now fall slower as a result of the Labour’s first budget.

Paul Dales chief economist at Capital Economics said: ‘We already thought that the Bank’s inflation concerns would mean it continues to cut rates by 25 basis points every quarter until mid-2025.

‘But in the light of the Budget, we have revised up our own GDP and core inflation forecasts.

‘And as a result, we no longer think the pace of rate cuts will quicken in the second half of 2025 and we now think rates will fall only as far as 3.5 per cent in early 2026 rather than to 3 per cent.’

Looking even further ahead than late 2025 and early 2026, economists vary on where they think interest rates will level off.

Santnader for example, thinks interest rates will remain between 3 per cent and 4 per cent for the foreseeable future.

Capital Economics is predicting that base rate will eventually level off at 3 per cent.

Should you fix for two or five years?

The majority of mortgage borrowers are opting for two-year fixed rate deals, according to analysis by Santander.

The bank said 60 per cent of customers are choosing two-year fixes at present in the hope interest rates will be lower when they come to remortgage in two years’ time.

Less than a quarter of its customers are opting for five-year fixed rate products, even though they are currently cheaper. The remainder are mostly choosing fixes lasting three or ten years, or trackers.

This represents a big shift, given that in recent years, Santander says its customers have tended to show a 60/40 split in favour of five-year fixes.

Choosing what length to fix for depends on what you think may happen to interest rates but should importantly take more account of what your personal circumstances are.

Key factors include whether you may move soon, how much you prefer the security of fixed payments for longer and how well you could cope with a rise in mortgage bills.

Fixed rates of any length offer borrowers certainty over what their payments will be from month-to-month.

Those opting for a shorter two-year fix are backing interest rates falling over the next couple of years, or at least staying steady, so that when it is time to remortgage their bills won’t rise.

With five-year fixes borrowers are locking in to rates that they know won’t change for longer, perhaps either because they believe rates may rise or because they prefer the security. Five-year fixes were hugely popular when rates were lower.

If rates continue to fall, a tracker mortgage without an early repayment charge could put borrowers in a position to take advantage.

However, for all the potential benefit, a tracker product will also leave people vulnerable to further base rate hikes in the meantime while also being more expensive than fixed rates at present.

Whatever the right type of mortgage for your circumstances, shopping around and speaking to a good mortgage broker is a wise move.

For a full rate check use This is Money’s mortgage finder service and best buy tables. These are supplied by our independent broker partner London & Country.

What are the best mortgage rates?

Bigger deposit mortgages

Five-year fixed rate mortgages

Santander has a five-year fixed rate at 4.14 per cent with a £999 fee at 60 per cent loan to value.

Nationwide has a five-year fixed rate at 4.14 per cent with £999 fees at 60 per cent loan to value.

Two-year fixed rate mortgages

MPowered Mortgages has a 4.21 per cent fixed rate deal with a £999 fee at 60 per cent loan-to-value.

Nationwide has a two-year fixed rate at 4.22 per cent with a £999 fee at 60 per cent loan to value.

Mid-range deposit mortgages

Five-year fixed rate mortgages

Nationwide has a five-year fixed rate at 4.24 per cent with a £999 fee at 75 per cent loan to value.

NatWest has a two-year fixed rate at 4.24 per cent with a £1,495 fee at 75 per cent loan to value.

Two-year fixed rate mortgages

MPowered has a two-year fixed rate at 4.31 per cent with a £999 fee at 75 per cent loan-to-value.

Santander has a two-year fixed rate at 4.35 per cent with a £999 fee at 75 per cent loan to value.

Low-deposit mortgages

Five-year fixed rate mortgages

Virgin Money has a five-year fixed rate at 4.62 per cent with £995 fees at 90 per cent loan to value.

Nationwide Building Society has a five-year fixed rate at 4.64 per cent with £999 fees at 90 per cent loan to value.

Two-year fixed rate mortgages

Virgin Money has a two-year fixed rate at 4.99 per cent with a £995 fee at 90 per cent loan to value.

Nationwide Building Society has a two-year fixed rate at 5.04 per cent with £499 fees at 90 per cent loan to value.

>> Check our our mortgage tracker to compare the latest available deals

Tracker and discount rate mortgages

The big advantage to a tracker mortgage is flexibility. The downside is they are currently more expensive, so it will take a few more interest rate cuts before borrowers starting beating the fixed rate deals.

The can sometimes be the case with discount rate mortgages, which track a certain level below the lenders’ standard variable rate.

A fixed-rate mortgage will almost inevitably carry early repayment charges, meaning you will be limited as to how much you can overpay, or face potentially thousands of pounds in fees if you opt to leave before the initial deal period is up.

You should be able to take a fixed mortgage with you if you move, as most are portable, but there is no guarantee your new property will be eligible or you may even have a gap between ownership.

Many tracker deals have no early repayment charges, which means you can up sticks whenever you want – and that suits some people.

Make sure you stress test yourself against a sharper rise in base rate than is forecast.

Compare true mortgage costs

Work out mortgage costs and check what the real best deal taking into account rates and fees. You can either use one part to work out a single mortgage costs, or both to compare loans

- Mortgage 1

- Mortgage 2