You have to feel for Rachel Reeves. After establishing a solid reputation in opposition, things haven’t gone to plan as Chancellor so far.

Her Autumn Budget led to widespread criticism over tax rises on employment and extra costs for businesses, while questions abound over whether her plans will deliver the growth Labour promised voters.

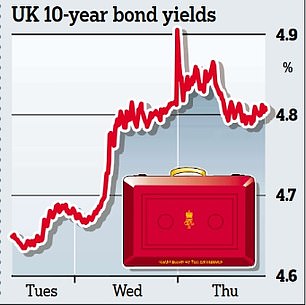

Now, a slow burn rise in the UK’s borrowing costs has led to gilt yields surpassing the levels seen after Liz Truss and Kwasi Kwarteng’s ill-fated mini-Budget.

That’s unfortunate for a Labour party that has spend the past couple of years citing a gilt yield spike as evidence of Liz Truss ‘crashing the economy’ and Tory mortgage penalties.

But is Britain’s current predicament Rachel Reeves and Sir Keir Starmer’s fault or do they just find themselves caught out by an unfortunate set of circumstances? Or is it a bit of both?

Where did things start to go wrong? Was it the Budget, or was it the claimed ‘£22billion black hole’ and months of miserabilism? And what are gilts and why do yields even matter?

On this This is Money podcast, Georgie Frost, Lee Boyce and Simon Lambert dig into what’s gone wrong with Britain’s finances and what it means for people.

Plus, in better news Lee looks at the jobs that delivered the biggest pay rises last year and why.

Simon explains what’s going on with the US hedge fund staging a raid on seven investment trusts – and why investors should make sure they vote.

And finally, Lee catches up with Dave Fishwick as the new Bank of Dave film is released.