Bloomberg recently published an article titled, “Donald Trump Has Tools to Fire Powerful Financial Regulator in Term Two,” referring to Consumer Financial Protection Bureau (CFPB) Director Rohit Chopra. The New York Times once called Chopra “Wall Street’s Most Hated Regulator.

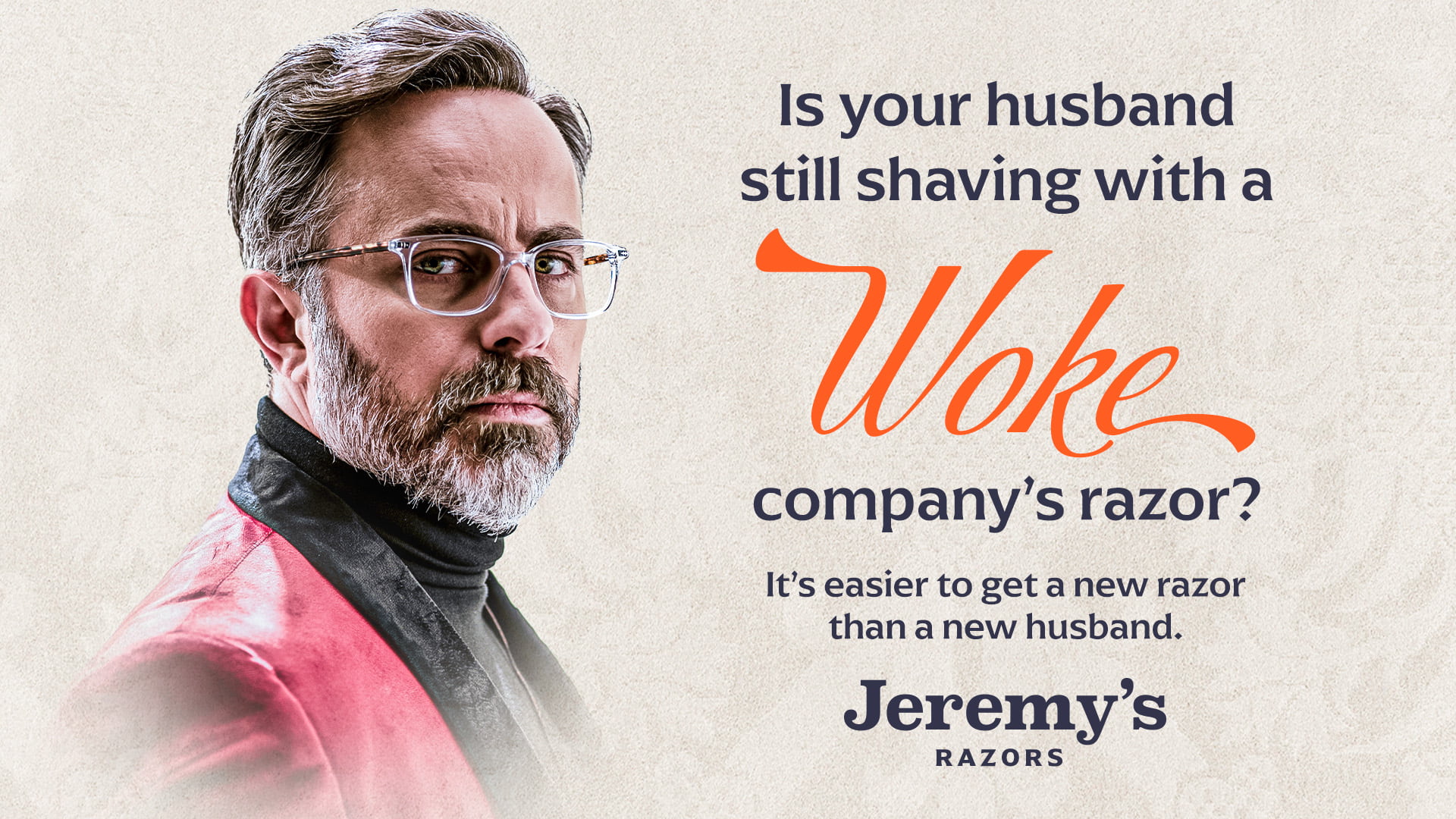

Advertisement

The CFPB, established in 2011, was designed to protect Americans from unfair financial practices, yet it was intentionally set up to operate beyond typical constitutional checks and balances.

Under Chopra’s leadership, the Bureau claims to enforce high standards on financial institutions, promoting transparency and ethical treatment for consumers. However, it appears unwilling to extend these same standards to its own workforce.

In 2024, while most federal employees received cost-of-living adjustments, the CFPB denied this adjustment to its staff. Meanwhile, it increased pay for top executives, with some managers now earning over $269,000 annually.

Is the CFPB leadership prioritizing itself over consumers and employees? Color me shocked.

As a result, the Bureau’s employees—those responsible for enforcing consumer protections—have been left without a contract since last year. They are stuck with a management team quick to demand rigorous oversight from the private sector but seemingly unwilling to treat its own employees with fairness and respect.

Consumer Financial Protection Bureau Hits Ohio Bank With… Protection Racket?

Rogue Agency: GOP Lawmakers Scrutinize the Consumer Financial Protection Bureau

Adding to the irony, in late October, the CFPB issued a rule mandating that private employers gain consent and provide transparency regarding worker data usage, claiming this would protect workers from invasive digital surveillance.

Advertisement

Director Chopra defended the rule, saying, “Workers need basic protections.”

If that’s true, why isn’t the CFPB applying similar protections to its own staff? Shouldn’t the Bureau model the transparency and ethical practices it requires of others?

Unfortunately, the CFPB repeatedly demands high standards from others while maintaining an opaque and dismissive stance with its own employees. These contradictions point to a leadership failure.

Chopra was once seen as a progressive champion, with Ohio Senator Sherrod Brown (D) stating during his Senate confirmation hearing, “Rohit Chopra will fight for all those who feel they’ve been left on their own.” Apparently, this commitment does not extend to Chopra’s employees, who are still waiting for cost-of-living raises.

With Chopra’s term nearing its end, the question remains: who will want to work with him after such a strained relationship with his own workforce?